The country’s largest lender State Bank of India reported a net profit of ₹838 crore for the quarter ended March 31, compared with the ₹7,718 crore loss during the same period of the previous year, as bad loans fell sharply.

The bank also reduced its one-year marginal cost of fund based lending rate (MCLR) by 5 basis points to 8.45%, with effect from Friday. Most of the loans are linked to the one year MCLR. Since April, SBI has reduced lending rates by 10 basis points. [100 basis points = 1 percentage point]

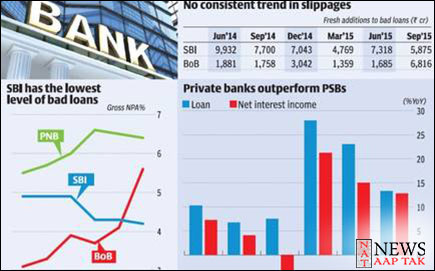

Compared to gross slippages of ₹33,670 crore in the fourth quarter of FY18, the bank reported ₹7,505 crore of slippages in the quarter under review. As a result, the gross NPA ratio fell to 7.53% form 10.91% a year ago, and 8.71% in the previous quarter. Net NPA ratio fell to 3.01% from 5.73% a year ago, and from 3.95% sequentially. Provision for bad loans fell 28% on year to ₹17,336 crore.

“We had said this will be a year of hope... we have lived up to the expectation,” SBI chairman Rajnish Kumar said during the post earnings press meet.

“Improvement in asset quality is very visible,” he said adding the bank is very close to a state of ‘equilibrium’.

The road ahead is also bright, Mr Kumar said, pointing to a ₹16,000 crore recovery expected from three accounts that are at the National Company Law Tribunal, for which SBI has already made 100% provision. These three accounts are Essar Steel, Bhushan Steel and Power and Alok Industries.

‘Recovery in sight’

“₹16,000 crore is recoverable as soon as the judicial process is over,” he said.

Further, the outstanding amount in SMA1 and SMA 2 category is only ₹7,000 crore, indicating lesser pressure on asset quality in the coming quarters. Special mention accounts (SMA) 1 & 2 indicate repayment overdue for 30-60 days and 6090 days. SBI shares ended 2.9% higher to close the day at ₹308.05.

“SBI Q4 results validate our view that the worst in terms of asset quality stress is behind for the bank. Also, SBI’s up-fronting of provisions for several individual large exposures, helps improve the medium term comfort factors for investors further,” said Lalitabh Shrivastawa of broking firm Sharekhan by BNP Paribas. The bank has a provision coverage ratio of 78.7% as on March end.

Net interest income of the bank increased 15% to Rs 22,954 crore during the period under review on the bank of 14% growth in domestic credit. Retail credit grew by 18.5%. The bank expects a credit growth of 1012% for the current financial year.

The net interest margin also improved 20 bps on year to 3.02% and the bank sees scope for further improvement in the margins.

0 comments:

Post a Comment